By Tkay Nthebe

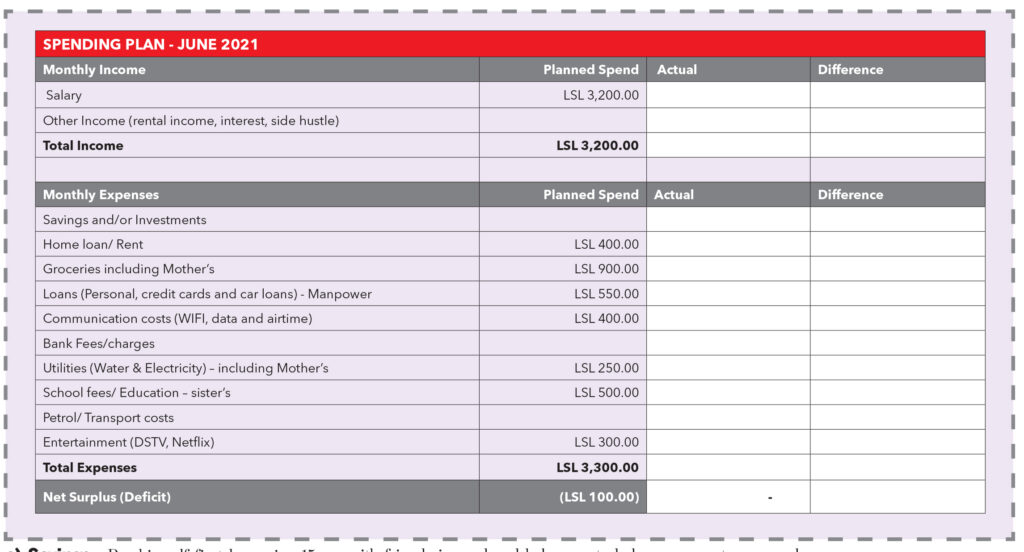

Meet Tsietsi, a 25-year old graduate from Motse-Mocha in Mafeteng. Tsietsi completed a Bachelor of Commerce (BCom) degree specialising in Marketing and has a passion for Digital Marketing. Since completing his studies, Tsietsi has struggled to find a permanent job, but has some experience having worked on short term contracts as an Intern. June is a good month for Tsietsi, because he has just been appointed as a Social Media Officer on a 6-month contract, earning a monthly salary of LSL 3,200.00.

Tsietsi decided to rent out a flat as he enjoys his own space, paying rent of LSL 400.00 and LSL150 electricity per month. To get to work, he takes a 4+1 every morning, he packs a lunch box and spends LSL 400.00 on groceries monthly. Tsietsi also helps his single mother with LSL 500.00 to pay for his sister’s school fees, LSL100 for electricity and LSL 500.00 groceries.

Being a Social Media Officer, Tsietsi spends a lot of time online, doing research and following trends. His weekly spend for data is LSL 100.00. He also enjoys going out with friends on weekends, spending LSL 300.00 monthly on entertainment. Tsietsi also has a monthly instalment of M550.00 to Manpower for the loan/bursary that funded his BCom studies, the outstanding amount is LSL18,000.00.

Tsietsi currently does not have any savings and is worried about what will happen when his work contract ends in 6 months.

If you were Tsietsi, how would you suggest he spends this money?

Using the template shared in the “How to create an exciting spending plan”, Tsietsi should consider the following:

a) Savings – Pay himself first by saving 15 – 20% of his income to build up reserves should the contract not be renewed. The minimum savings per month should be LSL 480.00 and should be transferred into an interest-bearing account.

b) Cutting down on expenses -Tsietsi can consider cutting down on the data usage and use the WIFI available at work to do this research. He can also opt for cheaper bundles by company network providers to reduce the LSL 400.00

c) Manage debt repayment – Discuss and negotiate an affordable payment plan with Manpower.

d) Be savvy with your shopping – Consider searching for specials and buying groceries in bulk and sharing for both households.

e) Additional income – While socialising with friends is good and helps create balance, Tsietsi should also explore ways to generate additional sources of income as discussed in the article titled “Monetize and increase your sources of income”. Examples to consider are tutoring Marketing students or freelancing as a copywriter.

f) Additional Steps to manage his spending: Tsietsi can also save money by walking instead of taking a 4+1 to work every day. Not only is this healthier, but also an opportunity to meet new people.

One of the biggest lessons I’ve learnt is that it does not matter how little or how much you earn, what matter is to plan. The “ncaa” thing for Tsietsi to do is to start, plan and manage his money if he wants to achieve financial prosperity. I am excited and looking forward to exploring how Tsietsi’s career unfolds and how much he actually saves. Stay tuned for the next article, likhomo!