Specialist producer Gem Diamonds reported improved annual profits on Thursday, after prices strengthened in the second half.

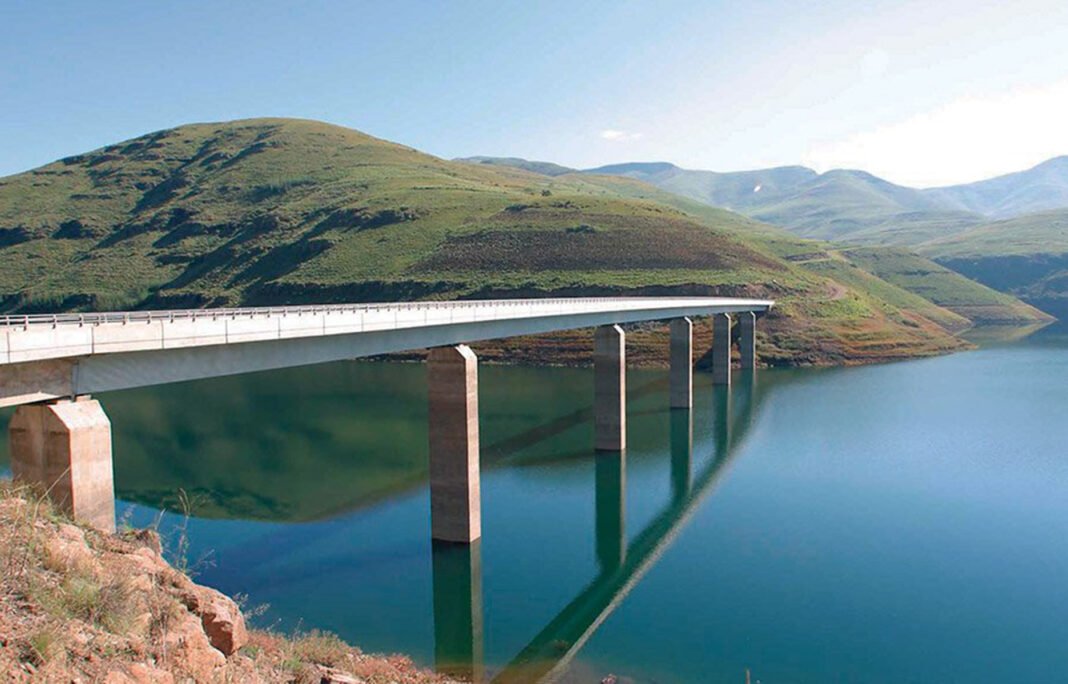

The London-listed firm, which owns 70% of the Letšeng mine in Lesotho, said revenues for the year to 31 December 2020 were M2.8billion compared to M2.7billion a year previously. Underlying earnings before interest, tax, depreciation and amortisation from continuing operations were M790million, against 2019’s M610million.

Pre-tax profits from continuing operations were M570million, up from M359million, while earnings per share on the same basis were 12.1 cents against 5.1 cents in 2019.

Gem, which specialises in higher value diamonds, said there had been significant uncertainty at the start of the pandemic.

Since then, however, demand had improved while prices achieved remained “relatively strong”. Supply was curtailed by the permanent closure of Rio Tinto’s Argyle mine in Australia and Covid-19 related interruptions elsewhere, while demand was boosted as China started to recover from the pandemic.

Chief executive Clifford Elphick said: “Gem has delivered positive operational and financial results during a very challenging year.

“The operational results were characterised by strong cash flows, the achievement of all revised operational metrics and the recovery of 16 diamonds greater than 100 carats each, the highest number recovered in a single year.

“The stronger prices achieved in the second half reaffirms the recovery of the diamond market and the unique equality of the Letseng production.”

A total of 100,780 carats were recovered from Letseng during the year, compared to 113,974 in 2019. The Letseng 12-month rolling average was $1,568 per carat in the first quarter, but improved throughout the year to reach $1,908 in the fourth quarter. That compares to $1,637 in 2019.

Looking ahead, chair Harry Kenyon-Slaney said: “Although the supply-demand dynamics of the diamond market remain positive, particularly for the unique high-value diamonds produced at Letseng, our immediate concern remains the ongoing protection of our people from the Covid-19 pandemic, which continues to cast a shadow over southern Africa.”

SP Angel said: “The Letseng mine has weathered the challenges of 2020 and [Gem] is recommending a dividend of 2.5 cents a share. The mine continues to deliver large, high-value diamonds on a consistent basis and Gem reports improving market conditions at least for higher value diamonds.”

As at 1230 GMT, shares in Gem were ahead 2% at 60.0p.