By Tkay Nthebe

“Never depend on single income, invest to create second source” Warren Buffet

The impact of the COVID-19 pandemic continues to negatively affect our personal finances, although domestic economic activity increased by 0.2% in the first quarter according to the Central Bank of Lesotho (CBL). The reality is that many lost their income, becoming desperate to make money quickly and take care of living expenses. The consequences is that many are falling victim to various pyramid scheme, promising unrealistic returns in a short period.

I recently received an invitation to buy shares and join a scheme that would make me between $5,000 and $10,000 (equivalent of LSL70,000.00 and LSL140,000.00). While LSL140,000.00 can move the needle in terms of my finances, I had to pause, think and do my research before investing my money. In this article, I would like to highlight 3 factors to consider before making investment decisions.

- Developing a solid investment strategy and setting goals

Planning your investments requires that you define the financial goals you’d like to achieve. Examples of investment goals can be “I want to earn income”, “I want to grow my capital” or “I want to earn income and grow my capital”. With the financial goal (s) defined, developing an investment statement policy (ISP) is key. This outlines the kind of assets to invest in, the risk you are willing to tolerant, expected returns and investment time horizon. The next step is to work on the strategy and determine which asset classes to consider.

- Determine the asset classes

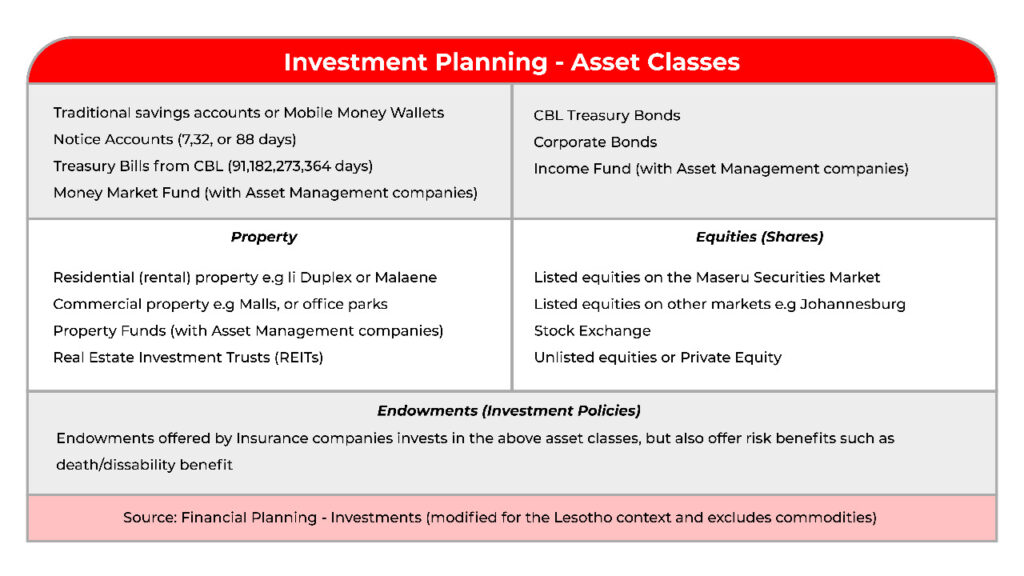

Based on your financial goals, choosing the correct asset class becomes important.

When planning your investment portfolio, it is key to identify which investment vehicles will help you achieve your financial goals. A good starting point will be to understand the different types of asset classes available, defined as the instruments that are grouped together because of their characteristics and performance. There are four main asset classes to consider when it comes to investments. This includes cash, bonds, property and equities (which will be discussed in more detail in the next article).

- Licensed institutions

It is important to do research before investing your hard-earned money. Part of this research is verifying if the institution you intend to invest in is registered and licensed. Practical ways to verify if the institution is registered is to look for a copy of the license issued by the Central Bank of Lesotho (CBL) or review the quarterly list of approved financial service providers (FSPs) available on the CBL website. In addition, the CBL issued a press statement on the 8thJuly 2021, warning Basotho about investing in two companies that are promising lucrative returns.

While increasing our sources of income, let’s remember that it takes time, consistency and hard work to build Leruo. There are no short cuts to success. Let’s do our research, plan and make “ncaa” money decisions. Likhomo!

Disclaimer: The opinion and views in this article are those of the author.