By Tkay Nthebe

“The question isn’t at what age I want to retire, it’s at what income?” George Foreman

It’s a new month and Tsietsi is determined to get his financial affairs in order, especially after reading an article that indicated that approximately 75% of Basotho and South African cannot afford to retire financially secure. This mortified and reminded him about ‘M’e Nthabi’s anxiety about retiring a few months ago.

July being national savings month, Tsietsi decided to reflect on his financial goals and use this time to construct a plan that would help him retire with financial security. The question on Tsietsi’s mind is “where do I even start to plan and prepare? Retirement seems so far away”

Well, the starting point would be for Tsietsi to determine the retirement goal and capital required.

The retirement capital is the total amount required in retirement, which can be used to buy an annuity or paid out as a lump sum (depending on the type of retirement fund). Building up enough capital for retirement takes many years and requires that one starts early. As discussed in the article “Get your head in the game and watch the score” it takes good planning, setting financial goals and starting early to achieve financial success. Tsietsi would need to also determine how much his monthly income would be (referred to as the retirement replacement income ratio) to still maintain his standard of living during retirement. He will need a good replacement income ratio to afford monthly groceries, utilities, healthcare etc. The recommended replacement income ratio should be 75% of your current income (assuming all debt has been paid).

The second option is to preserve retirement benefits when changing jobs.

Numerous people hastily cash out their retirement benefits to pay off debt, renovate their homes, buy new cars, or go on holidays. Consequently, they miss out on compounding interest benefits, that allow their money to grow over time. Preserving retirement benefits is therefore extremely important and can be achieved by transferring retirement benefits to the new employer’s (if you are changing employers) pension or provident fund, a Retirement Annuity or Preservation Fund with an approved Asset Management or Insurance Company.

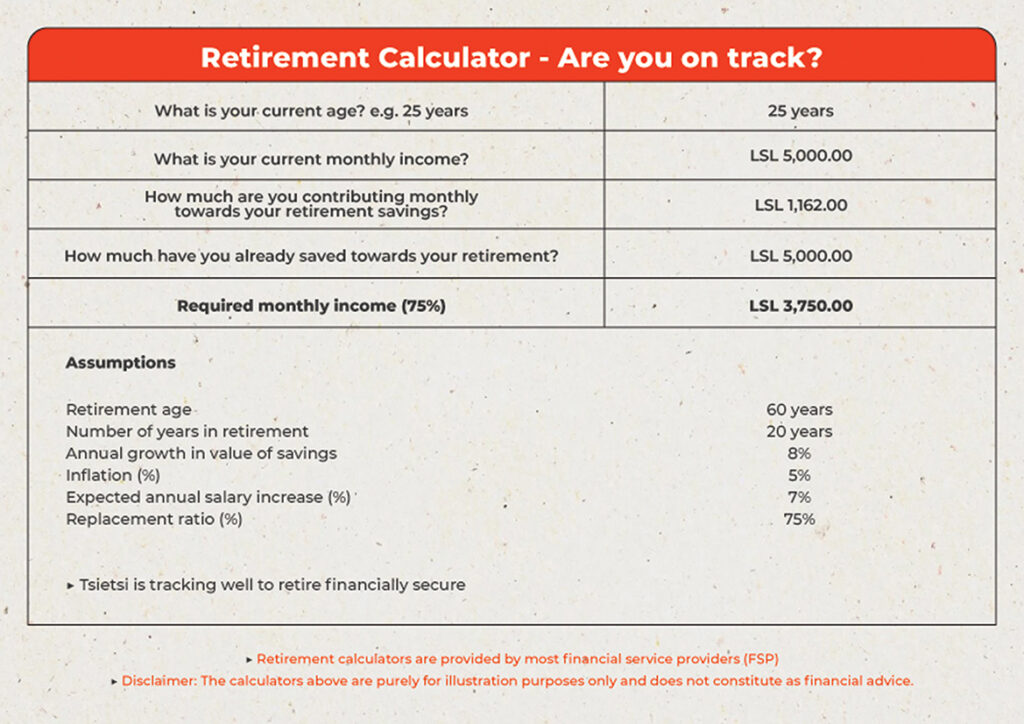

Below is a calculation Tsietsi can use to track his progress to financial security after retirement. Evidently, he would need to earn a monthly income of LSL 3,750.00 (75% replacement income) during retirement to still afford groceries, utilities, and decent healthcare etc.

The biggest concern for many pre-retirees is inadequate savings for retirement, adjusting to a new life and understanding annuities (which will be discussed in the next article). By planning and starting early, we can increase our savings for retirement and retirement with enough income. At what income do you want to retire?